The biggest financial scams in India surely have a domino effect and affect the world globally. They result in tainting the image of the country worldwide and giving the economy a tough hit, while the common man suffers. India has always been a victim of widespread corruption and lax government regulations.

Currently, the deadly Coronavirus is robbing people of their normal lives and wreaking havoc on the economy. However, in the past, a few individuals have harmed the country’s economy through corruption and malpractice.

We’ve compiled a list of 8 of the biggest financial scams in India that have drained billions of money from India :

1. Coalgate Scam – 1.86 lakh crore

The coal scandal, also known as the coalgate scam, was originally exposed in 2004 when India’s audit authority, the Comptroller and Auditor General of India, expressed concerns about inefficiencies in coal block allocation. The loss to the exchequer was first estimated to be more than Rs. 10 lakh crore, causing a political uproar. It was reduced to Rs. 1.86 lakh crore in the final report.

The CAG objected that, despite the government’s decision to allot coal blocks through a competitive bidding procedure, it ended up using an opaque and subjective method. Furthermore, it was made clear that there was no legal barrier to implementing a more transparent approach. The Supreme Court determined last year that the government’s allocation of coal blocks between 1993 and 2010 was unlawful.

2. 2G Scam – 1.76 lakh crore

The Comptroller and Auditor General of India (CAG), the country’s ultimate auditing body, released a report on the Department of Telecom’s granting of licenses and allocation of 2G spectrum on November 16, 2010.

CAG, then chaired by Vinod Rai, revealed that 2G licenses were given to telecom companies at a discount, costing the government Rs 1.76 lakh billion. Furthermore, licenses had been awarded to ineligible applicants who had omitted facts, provided insufficient information, presented counterfeit documents, and utilized fraudulent tactics to obtain licenses and hence spectrum access.

According to the CAG audit, license owners have sold major holdings to Indian/foreign corporations at a high premium in a short period. The true worth of the spectrum was assessed to be the premium received by these new entrants to the telecom market. These gains should have gone to the public coffers in a free and fair bidding process.

3. Commonwealth Games Scam – 70,000 crore

The Commonwealth Games (CWG) scam, one of the largest in India, occurred in New Delhi in 2010, involving theft of over Rs 70,000 crore. Only half of the budgeted cash was spent on Indian athletes, according to estimates. The athletes were allegedly requested to relocate from the substandard flats that the authorities had assigned to them.

According to reports from the Central Vigilance Commission, which is investigating the CWG scam, Suresh Kalmadi, the Chairman of the Games’ Organizing Committee, awarded Swiss Timings a contract worth Rs 141 crore for timing equipment that was overpriced by Rs 95 crore. All of the defendants, including Kalmadi, were charged with criminal conspiracy, cheating, forgery for the purpose of cheating, and violations of the Prevention of Corruption Act.

4. Satyam Scam – 14,000 crore

In 2009, the Satyam scam was the most widely publicized IT fraud. Satyam Computer Services was an IT firm owned by Mr. Ramalinga Raju. R. Raju acknowledged on the 7th of January, 2009 that he had tampered with the company’s accounts. According to a CBI assessment, the total cost of the incident was $1.47 billion. Satyam had previously received the Golden Peacock Award for best corporate governance in 2008, but it was revoked in 2009. SEBI prohibited Satyam’s auditors, Price Waterhouse Coopers, for two years and fined it Rs.13 crore. Satyam was also delisted from the NSE by SEBI.

Satyam’s stock, which was valued at Rs.544 in 2009 fell to a value of Rs.11.50, according to PWC. “We relied on the misleading information provided by Satyam computer services, causing financial statements to be inaccurate and untrustworthy,” the firm said.

Raju overstated13000 employees in his records and withdrew $200 million every month, according to the CBI.

A.S Murthy has been named the new CEO of Satyam Computer Services by the Indian government. Raju was released on bond on November 4, 2011, due to a lack of proof, but the matter remained unresolved. Finally, Raju was found guilty of colluding to exaggerate the company’s revenue, falsifying accounts and income tax reports, and faking invoices, among other findings, by a Hyderabad court on April 9, 2015, and sentenced to seven years in prison.

5. Vijay Mallya scam – 9000, crore

Vijay Mallya desired to grow his liquor and airline companies. His counselors constantly told him not to do so, but he ignored their advice. To support his airline company, he sold another company founded by his father.

Vijay Mallya’s kingfisher became India’s most popular domestic airline and every passenger’s first pick. The Indian government did not allow kingfishers to travel internationally due to several restrictions. To fly foreign flights, he used United Spirits or United Breweries to buy Deccan Air, a loss-making airline, and integrate it with Kingfisher Airlines, however, the merger failed to turn a profit, and Malaya’s business suffered a huge loss in 2010.

He relied on bank loans to keep his business afloat. He borrowed 9000 crores from 17 banks. Even though SBI had declared them bankrupt, other banks continued to lend him money because he was a member of the Rajya Sabha and various parties backed him. His company, the Kingfisher, also collected passenger service tax, PF, and employee income tax, but did not report it to the PF or IT authorities.

The corporation also failed to pay its employees’ salaries or ran out of funds. The company was forced to close its doors in 2012. Vijay Mallya got a debt of $9,000 from several banks, which he refused to repay.

6. PNB scam – 11,400 crore

A man’s or woman’s closest friend is a diamond, but diamantaires like Nirav Modi are not. One of the most contentious scams, this one allegedly took place under the Brady House brand of Punjab National Bank. This fraud implicated not only Nirav Modi, but also his uncle Mehul Choksi and two senior PNB officials.

PNB filed a case with the CBI in 2018 accusing Nirav Modi and his firms of getting Letters of Undertaking (LoUs) from PNB without paying the margin amount on loans. This meant that if those companies defaulted on the loan, PNB would be responsible for the repayment.

7. Harshad Mehta scam – 5,000 crore

In a country torn apart by substantial political and policy-based economic reforms in the 1990s, Mehta thrived and amassed wealth well beyond the norm. Harshad Shantilal Mehta, the perpetrator who drove the stock market to its knees, is commonly mentioned in connection with the 1992 stock market hoax.

The scandal involved a Rs 1439 crore ($3 billion) misappropriation, which resulted in a serious cash shortage and a significant loss of wealth in the life savings of many investors, totaling Rs 3542 crores ($7 billion). Due to purported political affiliations, Harshad Mehta is also depicted as a victim. However, it is true that Mehta took advantage of the loopholes for his own gain, manipulated the market, and was implicated in numerous banking crimes.

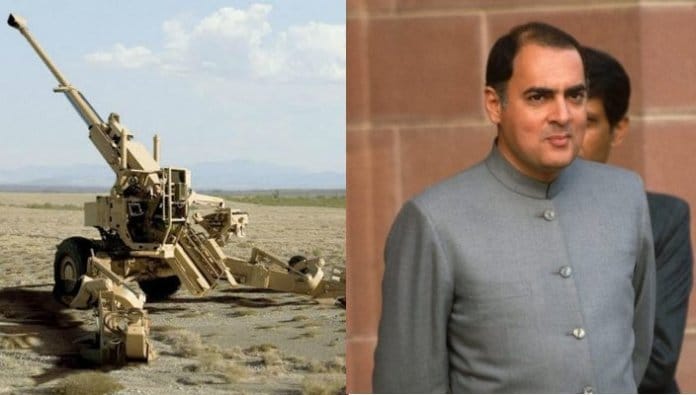

8. Bofors scam – 64 crore

India struck a Rs 1,437-crore deal with Swedish arms maker AB Bofors on March 18, 1986, for the delivery of 400 155 mm Howitzer cannons for the army. A Swedish radio station claimed a year later, on April 16, 1987, that the corporation had bribed key Indian politicians and defense officers to gain the deal. In the late 1980s, the Rajiv Gandhi-led government was rocked by the scandal.

The CBI filed a FIR on January 22, 1990, charging the then-President of Bofors Martin Ardbo, the suspected intermediary Win Chadda, and the Hinduja brothers with criminal conspiracy, cheating, and forgery. Between 1982 and 1987, it was alleged that certain civil servants and private individuals in India and overseas were engaged in a criminal conspiracy in which bribery, corruption, cheating, and forgery were committed.

Conclusion

With this, we conclude the 8 biggest financial scams in India to date. The list may provoke you to think that most politicians, many bureaucrats, and a big number of businesspeople and others are linked by a maze of unethical, unlawful, and illegal swindles in India. Well, To see at a brighter side, these scams would have enabled us and the government to be a constant watchdog to not let the money of the nation drain into some rich individual’s pockets. Where we would be standing right now at a global stage if we were devoid of these tragic and the biggest financial scams? let us know in the comment section.

Also Checkout: Union Budget 2022: How the government intends to tax future bitcoin transactions