Observing the current information:

The market ended on a very bad note on Friday 27th, as it was the worst day in the last 11 months. Trading on Monday might witness a further decline, some experts claim.

- BSE Sensex slipped 1,939.32 points.

- NSE Nifty shed 568.20 points to close at 14,529.15.

- Bank Nifty Slipped 1,745.40 points. (-4.78%)

The sell-off in the US market yesterday was the market’s response to 10-year yield touching 1.6%

In simple terms, the stock market gets nervous when bond yield increases because bonds are always safer than stock. When the bond yield increases, the stock market becomes less attractive to investors.

Investors are developing the sentiment that the US Fed has lost control of the bond market and yield will continue to increase. Further volatile ups and downs are expected until the people on wall street get comfortable with the bond yield levels.

On Friday, all major indexes around the world ended in red due to the above-intentioned sentiment.

The impact of the US bond yields also affected Asian markets.

- China’s Shanghai SE Composite Index ended the day 2.12% lower than the previous day’s close.

- Hong Kong’s Hang Seng was trading 3.43% lower.

- Japan’s Nikkei 225 ended the day’s trade 3.99% lower.

- Taiwan’s TSEC 50 Index closed after falling by 3.03%.

Why Indian Stock Market crashed

Inflation rates in India were much affected by the pandemic and the RBI is lobbying hard to maintain inflation targets of 4 percent with a 2 percent tolerance level on either side.

Indian investors felt that RBI might follow the American example and increase repo rates causing bond yields to rise. This sentiment created a selling pressure that was not controlled and that further led to a domino effect of panic selling.

The concept is simple if prices go lower, panicked traders will push them even lower.

FII / FPI s also pulled a massive amount of INR 8295.17 Cr and this also contributed to Friday’s Crash.

US Fed’s declaration to inject more liquidity and keep rates low through 2023 can influence the market to be buoyant this year.

What to expect :

The budget week also encountered similar instability. These are the two incidents that indicate a higher sale pressure if taken into account. Increasing bond yields continue to cause distress and the month of March has been unpleasant for the stock market.

Support and Resistance :

Support is a pricing range where a fall in demand or purchasing activity should be expected to stop. As the value of assets or securities falls, the demand for shares increases, thus establishing a line of support.

Resistance is a point or a pricing range that acts as a barrier because at that point there is pressure on the price of the asset. This pressure is because many sellers are trying to drive the price down from that level. Resistance breaks when new information, news, or sentiment comes to light and selling pressure is overwhelmed by emerging buyers.

When a supportive or resistant region or “zone” has been created, those prices can serve as possible entry and escapes because the price hits a supporting point or resistance point and does one of the two things — either get back up like a bounce or break the price level and go in its direction — until it hits the next level of support or resistance.

Target Levels for Monday

Nifty 50: Support at 14350 – 14300

Nifty Bank: Crucial support at 34,345 and 33,877

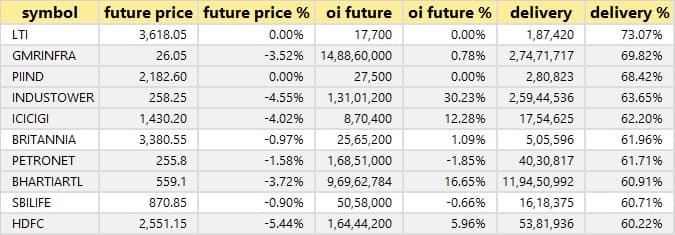

High Delivery Stocks

Analysts/Board Meetings

UltraTech Cement: Investor meeting to be held on March 1 which will be attended by the representatives of the company.

Finolex Industries: Analysts’/investors’ call on March 1, 2021.

Marico: Analysts’/investors’ meet – Virtual Roadshow – will be held from March 1 to March 3, 2021.

Torrent Power: The company’s officials will meet ICICI Prudential Life on March 1.

UTI AMC: The company’s officials will meet Motilal Oswal on March 1.

Chambal Fertilisers & Chemicals: The company’s officials will meet FIL India Business and Research Services on March 1, and ICICI Prudential Mutual Fund on March 2.

Computer Age Management Services: The company has scheduled an Analysts’ call on March 3 with Fidelity Management & Research (Japan).

Wipro: The company’s officials will attend HDFC Securities Technology Investor Forum on March 1.

R Systems International: The investors’/ analysts’ call of the company will be held on March 2 to discuss the financial results of the company for the quarter and year ended December 2020.

Welspun India: A board meeting is scheduled to be held on March 3 to consider the issuance of debenture, bonds, or any other form of borrowing.

JB Chemicals: Investors and analysts’ call with the management of the company is scheduled for March 2.

Stocks in the news

Indian Oil Corporation: The company will invest Rs 32,946 crore to expand Panipat refinery capacity to 25 million tonnes per year from 15 million tonnes per year earlier.

BL Kashyap and Sons: Acacia II Partners LP & Others reduced the stake in the company to 2.47% from 4.91% earlier.

Affle (India): The company at its board meeting approved the fundraising of up to Rs 1,080 crore.

Equitas Holdings: Investor CDC Group PLC reduced the stake in the company to 5.23% from 7.84% via open market sale.

Tata Chemicals: The company appointed Nandakumar S Tirumalai as the Chief Financial Officer after John Mulhall was elevated to Managing Director & CEO of subsidiary Tata Chemicals North America, Inc.

Acrysil: The company commences commercial production of additional 1 lakh units after completion of capacity expansion of Quartz kitchen sinks at Bhavnagar plant in Gujarat from 5 lakh units to 6 lakh units per annum.

Also read :

An introduction to the Stock Market