Amazon rates its success in terms of customer obsession, eliminating competition with low prices, reliability of tech and service, exceptional infrastructure, and consistent free cash flow.

The largest marketplace on Earth incorporates many companies and businesses under its roof and In terms of Operating Income, the growth has been mainly driven by the high margins deriving from the services sales.

Diversification strategy has been ambitious and hugely successful even when the world economy was devasted by Covid-19, Amazon boasted a net income of $ 21.33 billion in 2020.

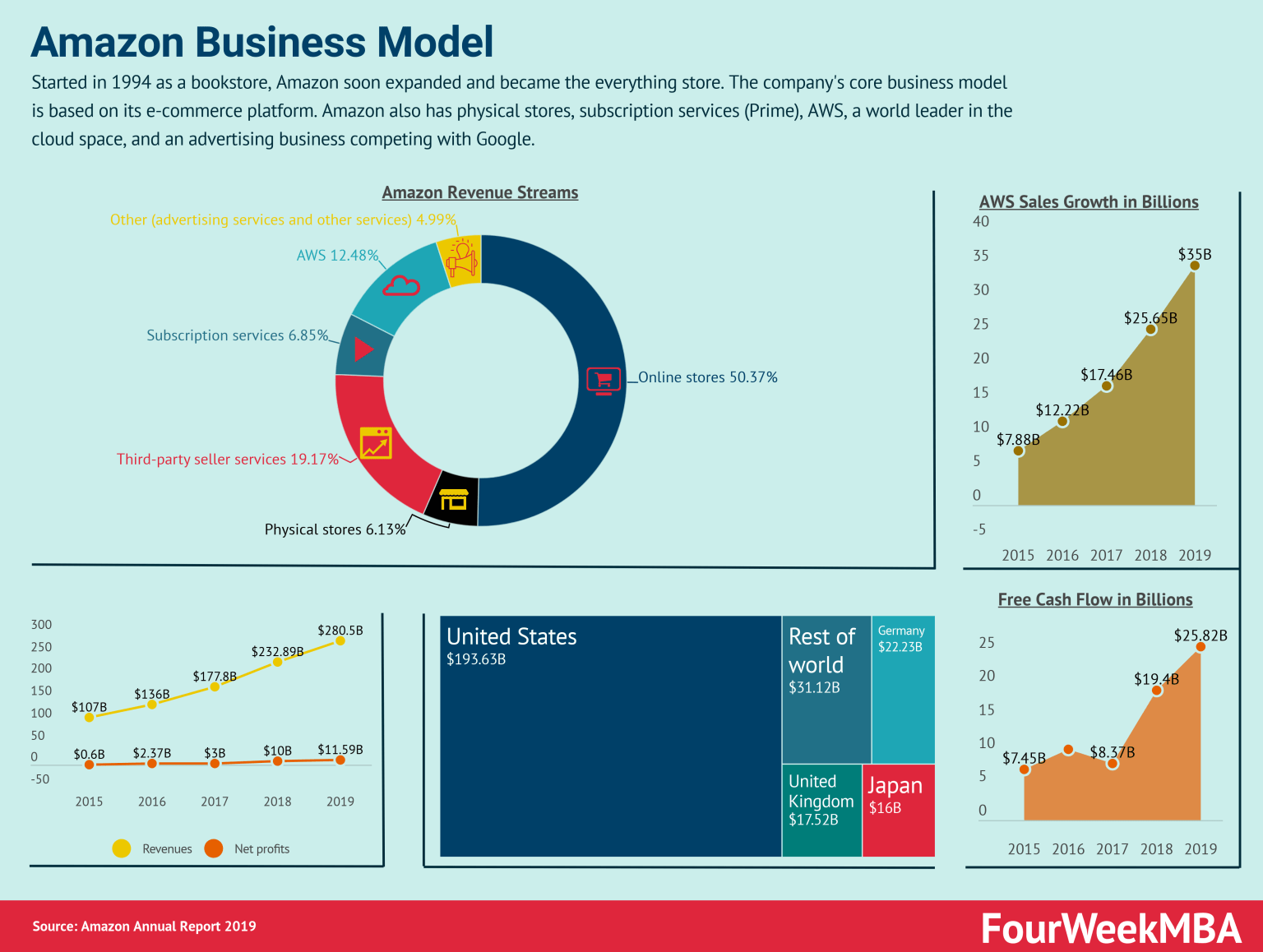

However, the biggest chunk of the pie which is 50 percent came from their online retail presence.

In America alone, Amazon has over 2.7 billion visits, while people spend more than 6 minutes on the site to look at a minimum of 9 pages in order to find what they are searching for.

Amazon’s Bussiness Model Has Four Pillars

Consumers:

In an annual report to shareholders, Bezos expressed how the company aims to and is serving its consumers.

Efficient product pricing and lucrative shipping offers along with reliable customer support are helping the company add new customers every day.

We serve consumers through our retail websites and focus on selection, price, and convenience. We design our websites to enable hundreds of millions of unique products to be sold by us and by third parties across dozens of product categories. Customers access our websites directly and through our mobile websites and apps. We also manufacture and sell electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, and Echo, and we develop and produce media content. We strive to offer our customers the lowest prices possible through low everyday product pricing and shipping offers, and to improve our operating efficiencies so that we can continue to lower prices for our customers.

Sellers :

We offer programs that enable sellers to grow their businesses, sell their products on our websites and their own branded websites, and fulfill orders through us. We are not the seller of record in these transactions. We earn fixed fees, a percentage of sales, per-unit activity fees, interest, or some combination thereof, for our sellers.

Amazon acts as a mediator between sellers and consumers and earns through a fee and percentage of sales commission-based method. The company innovates programs to boost seller earnings and provide product recognition.

Amazon Seller Rewards Program is an exclusive loyalty program designed to help the seller community grow and provides them the opportunity to earn reward points by participating in various offers and contests. These reward points can then be redeemed against a range of interesting options like Sponsored Products ads credit, services from third-party Service Provider Network or to buy products from the company itself.

Developers and enterprises:

We serve developers and enterprises of all sizes, including start-ups, government agencies, and academic institutions, through our AWS segment, which offers a broad set of global compute, storage, database, and other service offerings.

Content creators:

We serve authors and independent publishers with Kindle Direct Publishing, an online service that lets independent authors and publishers choose a 70% royalty option and make their books available in the Kindle Store, along with Amazon’s own publishing arm, Amazon Publishing. We also offer programs that allow authors, musicians, filmmakers, app developers, and others to publish and sell content.

The Revenue River

Infographic tells that Amazon makes the most money from the retail sector but the actual picture is much more complicated.

The retail giant actually loses money on its international retail operations. In 2018, the company reported international sales valued at $66 billion and the operating expenses for gaining international market share were $68 billion.

The company’s retail segment only produces about $5 billion of operating income on that $208 billion in sales.

Amazon sells its products at a slim margin, the cost of sales for Amazon is almost as high as the revenue generated by its products

This is an effective strategy that sacrifices product margin and bleeding money to acquire market share and establish dominance.

Other Services of Amazon such as AWS, Advertisement service, Prime operate on very high margins and contribute to the company’s profitability.

Amazon is the undisputed leader in the cloud services space: Currently, it owns 31 percent of the global cloud computing market followed by Azure at 27 percent and Google at 7 percent.

The Cash machine

Despite the tight profit margins, Amazon is never short on Cash. The company has managed the cycle of repayments and payment collection so efficiently that it always has enough days to use the cash generated by sales to make investments and finance operations.

It collects cash from consumers immediately while pays the sellers relatively later, resulting in short-term liquidity available to the retail giant.

Also read: