Global climate change has already had noticeable consequences on the environment. Glaciers have dwindled, ice on rivers and lakes is driving off earlier, plant and animal ranges have shifted and trees are flowering faster. Impacts that scientists had foreseen in the past would result from global climate change are now happening: loss of sea ice precipitating sea level rise, and longer, more severe heatwaves. This is where CREO enters the scene. Read on to know more.

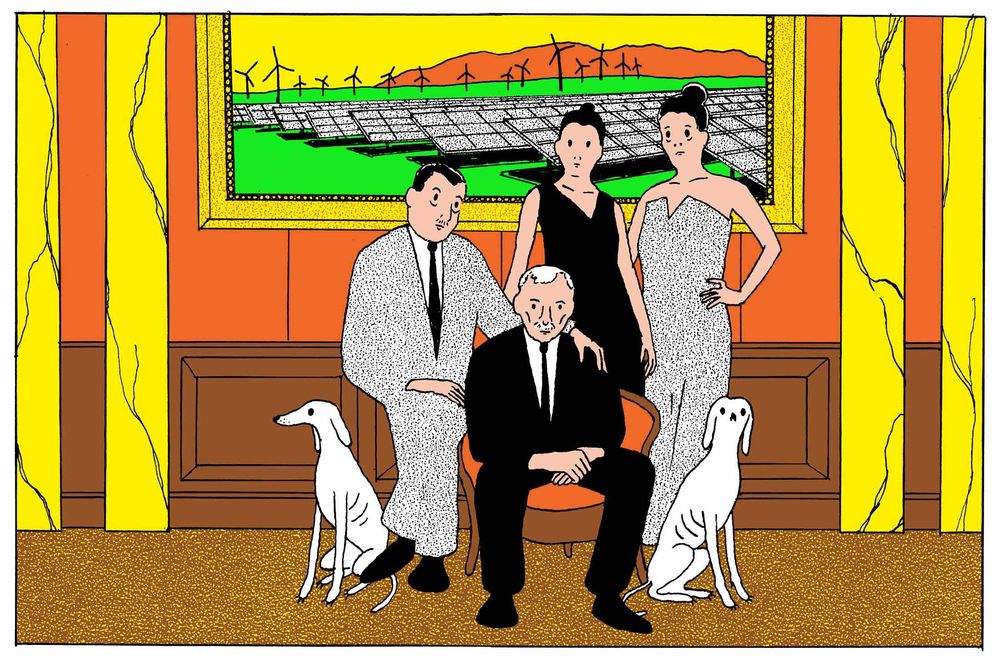

The Mulliez family, headed by Gerad Mulliez is one of the wealthiest families in France which regulates a distribution network empire throughout Europe.

The company owns one of the largest retail empires in the world and has launched more than 20 different retail enterprises including Auchan, Boulanger, and Decathlon, and many other brands.

With a hundred partners and a global retail empire worth more than $38 billion, the company decided that they should take climate change more seriously, should try to combat it, with €200 million ($236 million) to invest each year.

But the question is where to invest?

What better than to invest in a small, secretive non-profit club fighting climate

Change, ”CREO syndicate.”

What is the CREO syndicate?

When you think of those, fighting for a livable future and governing against the climate problem, who comes to mind? Maybe it’s institutions like the Sierra Club, youth-led organizations like Zero Hour but behind the scenes, some enormous financial players work hard to make a profit while combating climate change.

Like CREO (Clean, renewable, environment and opportunities) Syndicate is a 501c3 public charity founded by wealthy owners and family offices with a goal to address some of the most clasping environmental challenges of our period influencing communities across the globe – climate change and resource deficiency – by catalyzing private capital into creative solutions to conserve and maintain the environment and stimulate the evolution to a more sustainable economy for the benefit of the public.

How CREO functions

Being a non-profit club, CREO doesn’t have any capital of its own to deploy, it acts a little like an investment bank, vetting about 300 deals per year, engaging investors with possible partners, and executing research on technologies.

How to get a membership of CREO?

- The group focuses on the richest of the rich, working with about 200 families and investment outfits with a total of more than $800 billion under management.

- Members must have aids of at least $100 million and get ratified by the nonprofit’s board. They must prove their seriousness by intending to make their first investment in climate and sustainability within the timeline of six months.

- Members must pay dues—a “very reasonable” flat fee, that adds up to about half the non-profit’s revenue.

- Members should invest in everything from batteries and hydrogen fuel to regenerative farmland and greener product packaging.

What progress it has made so far?

In four years, the non-profit’s membership has quadrupled, and its members and affiliates’ assets have risen eightfold, from less than $100 billion in the year 2016 to $ 800 billion in 2020.

The organization is strictly invitation-only with the mantra “no tourists allowed.”

The non-profit club is working with CDPQ, a Quebec pension fund with $333 billion in assets, which launched a $500 million investment strategy around climate and sustainability. The non-profit club also invested in early rounds of Tesla Inc. and Beyond MeatBeyond Meat, two of 2020’s best-performing stocks.

This kind of success enables convincing suspicious family members and advisers to trust CREO.

So how long should a company wait for the results?

“This is not philanthropy, this is an investment,” says Regine Clément the CEO and President of the company. The CREO members invest in a wide variety of portfolios that might make a difference and make fortune. Super prosperous families, have an advantage over other players, Organizing money for future generations, they have to wait a decade or more for interests to bear fruit. Several members in Europe have been rich for hundreds of years. Families are inherently inclined to think long term.

Several investments aren’t mainstream, but it’s fine, as these families are comfortable being pioneers. What Creo is doing today is basically a preview of what institutional capital will do very soon.

Also read: Environment Ministry drafts dreadful EIA amendments: “Ease of Business” outbids sustainability

Ecotourism: A sustainable balance between Tourism and Ecological Conservation