Reliance Industries Limited, owned by one of the richest billionaires in Asia, Mukesh Ambani, and Amazon, a multinational company that entered India in 2013, both companies have entered an E-Commerce war. Each one is trying to defeat its rival. This is the state of the biggest war in Indian history. To make India self-reliant, the native company (Reliance) is already giving tough competition to its rival (Amazon).

Major variables (from the consumer’s point of view) to understand E-Commerce players’ position

(1). Cost- Both Reliance and Amazon focus on bringing down the cost as much as possible. But, Reliance natively has greater and recognized tie-ups with the industrial sector, which helps serve better quality products as well as less processed products.

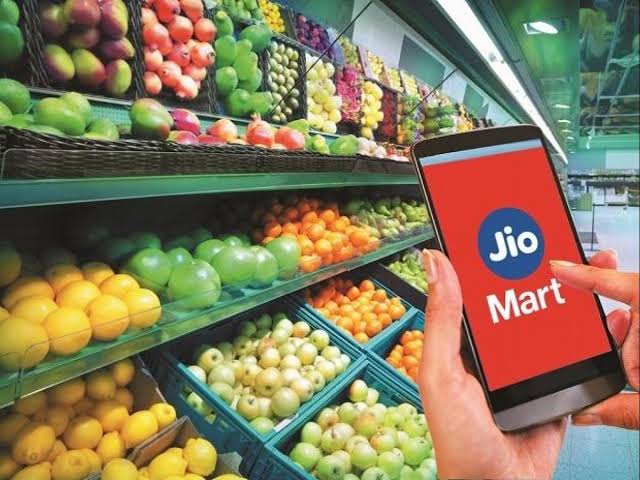

(2). Delivery Time- Amazon has got 60 plus warehouses in 15 States, whereas Reliance has got 12,000 micro-warehouses in 7000 cities, which exist in the form of ‘Reliance Retail Stores’ and ‘JioMart’ as well.

Reliance provides its customers with a dual facility. Either customers can visit the store themselves for shopping or they can get the whole list delivered in a few hours, whereas on Amazon, it takes 2-3 or more days for delivery.

This difference is because of one factor—the distance between the warehouse and the customers. Reliance easily overcomes the duration because of it’s micro-warehouse-based stores. A short distance from stores also eliminates the additional packing and shipping charges.

(3). Variety of Products- Both players have a huge variety of products. Additionally, because of its global supply chain, Amazon prevails over Reliance in some categories of products that are not available in India.

(4). Return Policy – Returns are the largest challenge to e-commerce for both retailers and manufacturers. It is one of the essential features of E-Commerce. In e-commerce, it is 20 to 30% that gets returned. It is examined that 79% of consumers want free shipping.

The return policy can be called a ‘Reverse supply chain’ of shipments, which is a billion-dollar loss venture for Amazon but not so much for Reliance. Why?

Again, the distance between warehouses plays a major role. Since Reliance retail stores are located nearby, they save on packaging, labor, and transportation costs in the reverse supply chain. Whereas, for Amazon, it takes days to complete the reverse supply chain.

Government Regulations for MNCs

Governmental regulations have a massive role in protecting Indian giants as well as small Start-up-based companies. The below-mentioned points are not only beneficial for native companies but also contribute to making a self-reliant India;

India allows 100℅ of FDI (Foreign Direct Investment) in the marketplace model of e-commerce, which it defines as a tech platform that connects buyers and sellers, but India has not allowed FDI in inventory-driven models of e-commerce. (Amazon has inventory-driven models of e-commerce.)

The Competition Commission of India has also placed strict restrictions on Amazon selling its products in the form of Amazon basics.

In 2018, India announced that international companies are not allowed to own more than 15% of the local brick-and-mortar supermarket supply chain.

Future Edge

Most probably, ‘JioMart’ and ‘Amazon Basics’ are going to be tough rivalries in the coming future.

Amazon has a diversified revenue plan that includes advertising, Amazon Prime, and eBook Kindle editions. On the other hand, Reliance is also aiming to come up with a conventional market by 2035, including native batteries and other records. The world’s first rooftop drive-in theatre was launched on November 5th by Reliance this year.

To Sum it Up

As of now, on the outside, it seems as though Amazon cannot match the number of brick-and-mortar stores as Reliance. Amazon cannot use the inventory model as planned. Lastly, Amazon cannot sell its products as much as it planned

Also Checkout: The Talent Acquisition challenge in the Covid-19 affected the Startup ecosystem.

What a article!!!

Really liked it..

Superb job Bhavika Samtani.