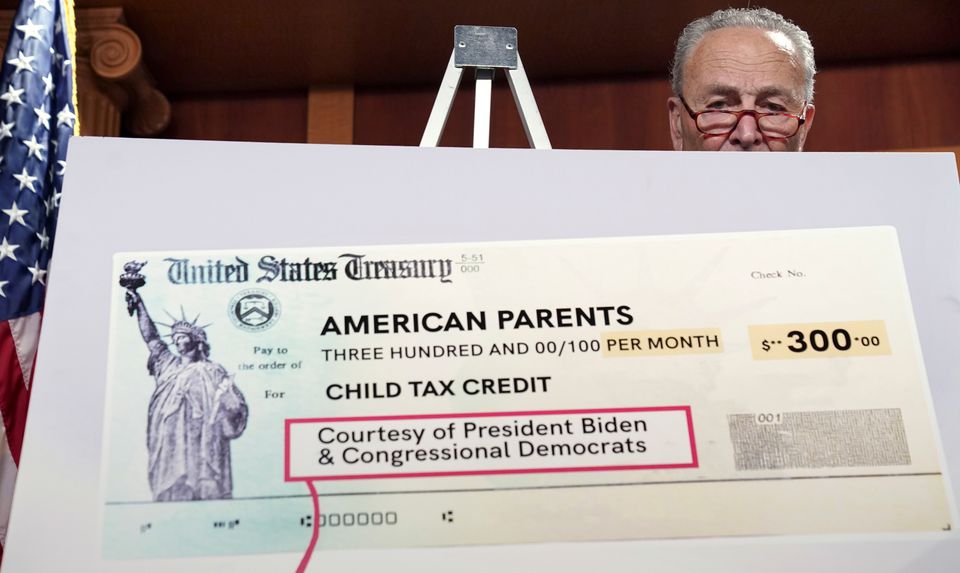

WHAT IS IT?

It is a tax benefit given to American taxpayers for each dependent child who is either a U.S. citizen, or U.S national, or U.S. resident, to support their families. It is estimated that this credit will help to reduce children living in poverty by 45%.

BENEFITS OF AMERICAN CHILD CREDIT

Tax Credit for 2020 is an income tax credit of up to $2000, that is, ₹1,49,506 per eligible child, under the age of 17 and it may be partially refundable.

It has been increased to $3600, that is, ₹2,96,121 for each eligible child under the age of 6 or $3000, that is, ₹2,24,267 for each eligible child under the age of 18 for 2021 credit, which is fully refundable. It was implemented on July 15, 2021, and was distributed to all eligible taxpayers. It will be continued every month.

FOR 2020

Eligible taxpayers can claim a tax credit of $2,000 per dependent child under age 17. If the amount of the credit exceeds the tax owed, then the taxpayer generally is qualified for a refund of the excess credit amount up to $1,400 per child.

The additional child tax credit, that is the refundable amount, was designed to help taxpayers whose tax liabilities were too low to benefit from the credit.

FOR 2021

For 2021, the credit increases, and the age for a qualifying child are extended to 17.

The credit amount rises to $3,000 for children under age 18 or $3,600 for children younger than 6 and becomes fully refundable to the extent it exceeds the taxes owed.

HOW IT’S DONE

While preparing for their tax returns in 2020, taxpayers should have calculated and compared the amounts of the child tax credit based on their incomes for both the 2019 and 2020 years to determine which year provides a greater benefit. Additional Child Tax Credit, that is, the refundable amount of the 2020 credit, considers the taxpayer’s annual income. Because of the pandemic, many citizens had lower earnings in 2020 than in 2019, so this rule allows taxpayers to calculate the amount of their credit for 2020 based on their earnings for 2019.

But for 2021, taxpayers whose direct deposit information is with the IRS, Internal Revenue Service, are eligible for the credit. They have already received advance payment in their bank accounts on 15 July through the electronic deposit.

Also Read: PM Modi’s Mann Ki Baat 90 per cent fall in revenue in the last three years