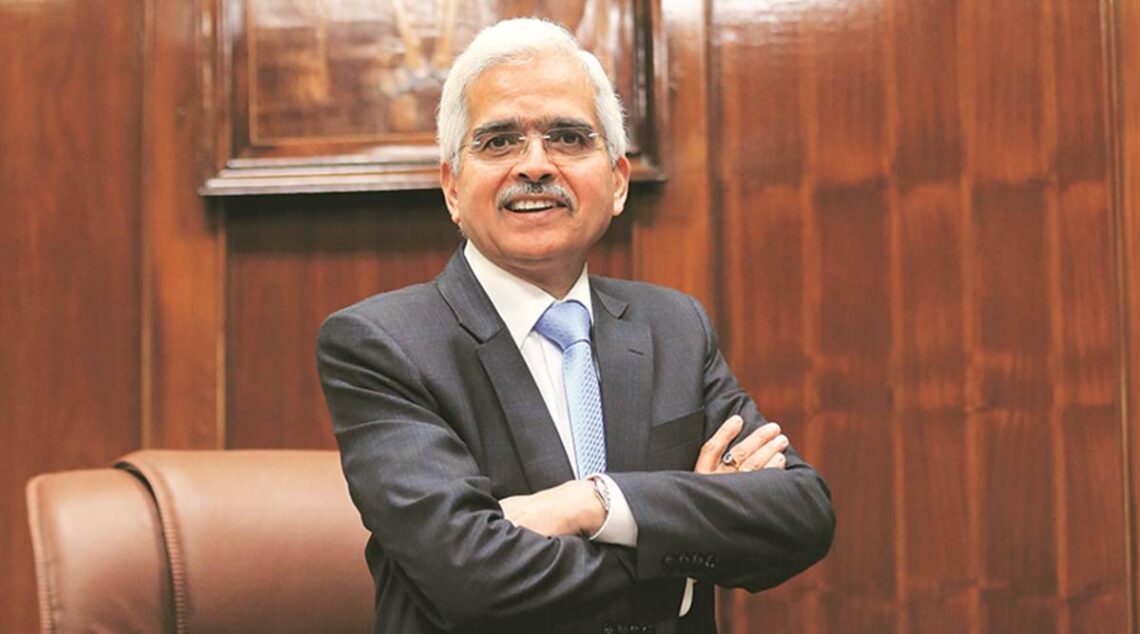

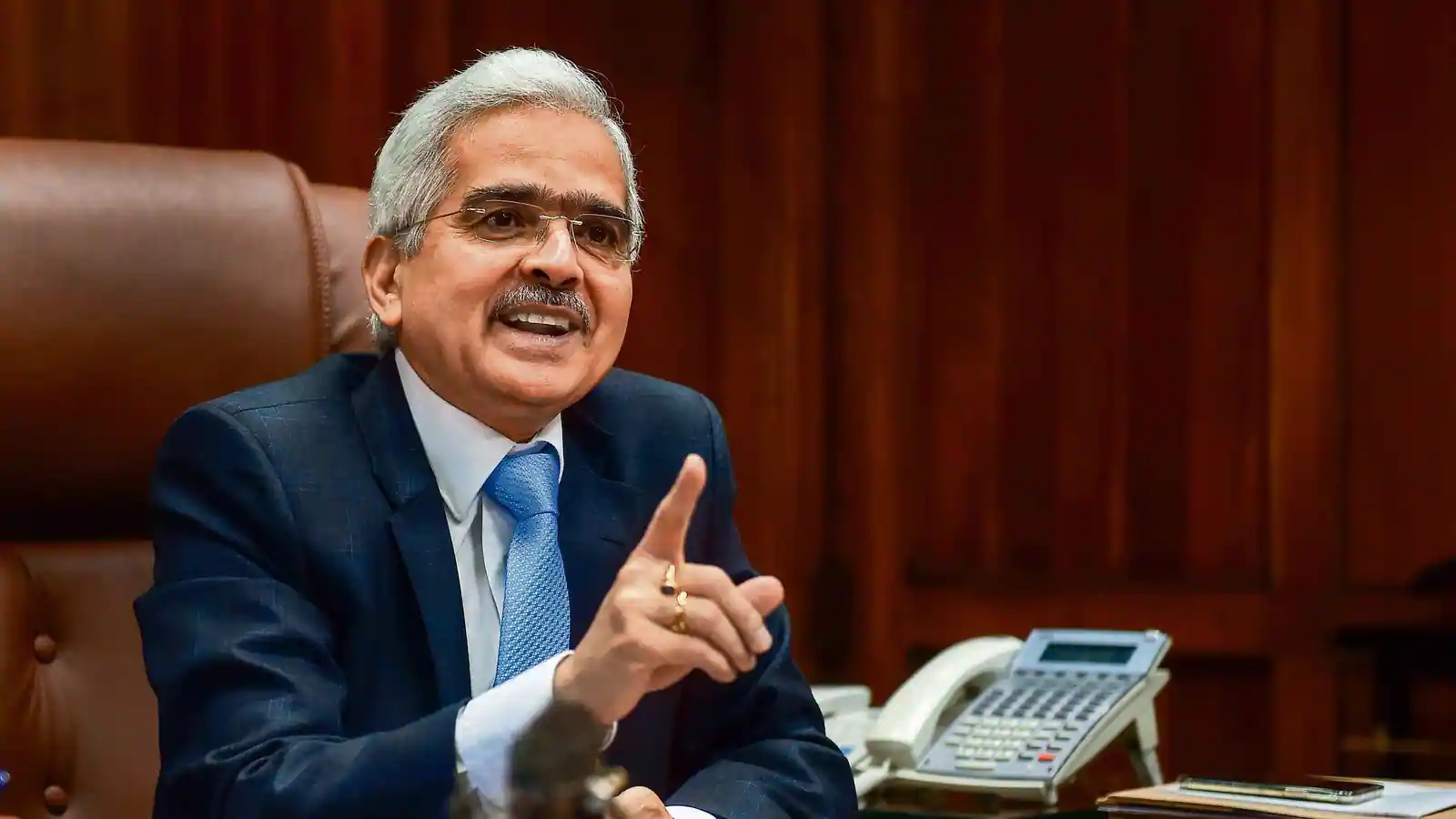

Reserve Bank of India Governor Shaktikanta Das on Thursday said that to make the post-pandemic recovery more equitable and sustainable, financial inclusion will continue to be a “policy priority”.

Speaking at the Financial Inclusion Summit by Economic Times, the Governor said that the central bank will come out with its first financial inclusion index.

This will help keep track of progress with respect to access, usage, and quality, he said. Das stated that the announcement for such an index has been made some time back, to keep a check on the extent of financial inclusion in the country.

“The work on FII is underway and the index will be published very shortly by the Reserve Bank,” he added.

Speaking on India’s GDP growth rate, Das said, “GDP growth rate projected by RBI for FY22 is 10.5 percent. I don’t see any reason to revise the growth projection downwards.”

He added that the stakeholders are responsible for the inclusiveness of the financial ecosystem and are “capable of effectively addressing risks like mis-selling, cybersecurity, data privacy and promoting trust in the financial system through appropriate financial education and awareness.”

Giving credit to Pradhan Mantri Jan Dhan Yojana scheme by the Union government, Das said that the central bank has been working since the start of the decade towards financial inclusion and reaching the grassroots. He said that the “technological advances” have made it easier to make banking more accessible.

“In order to make the post-pandemic recovery more inclusive and sustainable, FI would continue to be our policy priority,” he said.

Highlighting RBI’s work towards its goal, Das mentioned the Payment Infrastructure Development Fund (PIDF), which focuses on providing momentum for the development of payment acceptance infrastructure in Tier-3 and 4 cities. This approach is also implemented in the northeastern states of India.

“RBI will continue to address the concerns of over-indebtedness of microfinance borrowers, enable the market mechanism to rationalize the interest rates, and empower the borrowers to make an informed decision by enhancing the transparency of loan financing,” he said.

Weighing on the role of financial inclusion for sustained and balanced economic growth, which in turn reduces inequality and poverty, Das said that the pandemic has posed newer challenges and complexities in the way.

He said, “the financial system will have a crucial role to fulfill the aspirations and needs of our economy on the mend.”

Speaking on the impact of the pandemic on the livelihood and lives of the citizens, Shaktikanta Das said that the second wave earlier this year washed away the recovery path the economy took in the second half of 2020-2021.

“Our efforts towards financial inclusion, have helped in enabling the Government to provide seamless and timely financial support to vulnerable sections through direct benefit transfers (DBT).

The RBI has taken a slew of measures to mitigate the impact of COVID, including rate cuts, on-tap liquidity, cash reserve ratio exemptions, and tweaks in the priority sector lending scheme,” he said.

He also pressed on the Centre for Financial Literacy (CFL) project, aimed at achieving higher financial literacy by block-level participation, by the year 2024, which also happens to be the next Lok Sabha election year.

Also Read: Wholesale Inflation Eases To 12.07 Percent In June